Taxpayers mail all sorts of things other than tax returns. There are other information returns, petitions, and payments, all of which are crucially important to arrive at the IRS on time. Taxpayers use USPS, DHL, FedEx and UPS. Taxpayers drop things off at the post office or the FedEx or UPS Store. They might even drop it in the USPS, FedEx or UPS mailboxes. They might even have someone else run this very important errand. And then there’s the postage meters in the back office, like Pitney Bowes, that are totally controlled by the user. And there is also internet postage like Stamps.com. Timely mailed equals timely filed, or not?

THE HISTORY!

A very long time ago, in the tax years preceding 1954, tax returns and other IRS documents were considered timely filed if and only if they were physically delivered to the IRS by the due date. This was considered harsh by some courts who in response began applying the more lenient common law mailbox rule that was used in contract law. If you ever took contract law, you may remember this as an acceptance to an offer is effective when it is mailed and not physically received by the offeror.

What is the common law mailbox rule? If you say you had the right address and enough postage, the intended recipient got it. Senders could also provide testimony, affidavits, or some other circumstantial evidence as proof of timely mailing. Proving timely mailing creates a presumption of timely filing. The resulting presumption which is rebuttable forces the burden of proof onto the intended recipient. In our case, the IRS now having to prove they didn’t receive it. Intuitively, it would be kind of challenging to prove you didn’t get something.

THE STATUTE.

Congress noticed and in 1954 gave the IRS Internal Revenue Code Section 7502, Timely mailing treated as timely filing and paying. Congress basically said the common law mailbox rule was crazy and created the statutory mailbox rule legislating that USPS postmarks determine timely filing (and include any date recorded by any designated delivery service). As long as the USPS postmark is on or before the due date, you have timely mailed, timely filed, and/or timely paid, regardless of when physically delivered to  the IRS – the presumption of delivery. Code section 7502 also says there is a presumption of delivery from you to the IRS when you send by registered or certified mail. The date of registration is the postmark date for registered mail and the date on the receipt is the postmark date for certified mail.

the IRS – the presumption of delivery. Code section 7502 also says there is a presumption of delivery from you to the IRS when you send by registered or certified mail. The date of registration is the postmark date for registered mail and the date on the receipt is the postmark date for certified mail.

But what if the IRS says, we didn’t get your return (or petition, or payment)? How do you prove the postmark? How do you prove you stood in line 34 minutes at the post office on the due date and watched the government employee smack the red postmark on the envelope with your important IRS stuff in it? How do you prove the Post Office smacked the red postmark on the envelope with important IRS stuff in it that you dropped in the mailbox the week before the due date? You can’t and you don’t; therefore, you have no rebuttable presumption. 7502 does not address if the common law mailbox rule applies in these scenarios. So, over the years, the decisions of district and circuit courts have been all over the place as to whether the law embraced or kicked to the curb (supplements or supplants) the mailbox rule.

The IRS decided to fix this by enacting regulations which were finalized nearly a decade ago, in 2011. Regulations are a federal agency’s or department’s interpretations of the law when the law is either silent, vague or ambiguous. Basically, making up rules as they go  along. The Treasury Regulations (IRS rules) kicked the common law mailbox rule to the curb. There was to be no more presumption of delivery. There was to be no circumstantial evidence like affidavits and counting days. Taxpayers ever since have had to demonstrate direct proof of delivery to the IRS. Simply, put the rules are unforgiving and as harsh as when we started pre-1954.

along. The Treasury Regulations (IRS rules) kicked the common law mailbox rule to the curb. There was to be no more presumption of delivery. There was to be no circumstantial evidence like affidavits and counting days. Taxpayers ever since have had to demonstrate direct proof of delivery to the IRS. Simply, put the rules are unforgiving and as harsh as when we started pre-1954.

In practice, the statute requires a USPS postmark and the subsequent regulations assume there is a postmark. It is the postmark that triggers both the statute and the subsequent regulations. The gap between the two is when there is no postmark – and thus the common law mailbox rule lives on.

AND TODAY.

A January 2020 Tax Court ruling stemming from a 2017 case in which the taxpayers’ attorney dropped a tax court petition in a mailbox four days before the due date. Tax Court got the petition some three weeks after the due date. The envelope looked well-traveled but lacked a USPS postmark. The IRS jumped quickly: no postmark – no statutory mailbox rule – no timely filing – no jurisdiction. The Tax Court judge in the case allowed an affidavit from the attorney, counted Monday the 17th the same as Friday the 14th, and threw in judicial recognition of a holiday (July 4). After all that, Tax Court concluded that it was more likely than not that the petition was mailed when the attorney said he mailed it. Taxpayer – 1. IRS – 0.

WRAPPING IT UP.

For the foreseeable future there will be situations that result in paper filing. We recommend document, document, document. If it isn’t documented, it didn’t happen. File by registered or certified mail or use an IRS designated private delivery service IRS Approved Private Delivery Services . Keep a copy of the envelope to prove the address, the contents mailed, and the postmarked green card or receipt. Additionally, obtain delivery confirmation by following the tracking number online. Scan and upload the packet for posterity.

If e-filing a tax return, ensure Form 9325, Acknowledgement and General Information for Taxpayers Who File Returns Electronically, has a box or two checked. If you pay a preparer, be sure to get the completed 9325 from them.

WHAT ELSE DO I NEED TO KNOW?

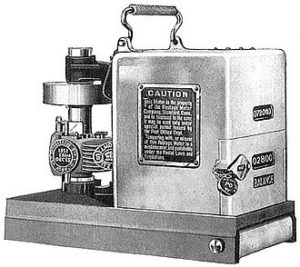

The first postal meter to be commercially produced and distributed was invented by Arthur Pitney and was approved by the USPS on November 16, 1920. And then it literally  took an act of Congress to allow the printing of postage directly on the mail.

took an act of Congress to allow the printing of postage directly on the mail.

Never assume an envelope will be postmarked the day you “mail” it.

Shameless Plug. Entrust McAtee & Associates with your IRS dealings: returns, petitions, and payments.

info@accpas.com OR 727-327-1999.

We’ll be back next week. In the mean-time be sure to like us on Facebook and follow us on Twitter.

McAtee and Associates’ Disclaimer:

Our blog is intended for educational and awareness purposes. The general information provided about taxes, accounting, and business-related topics is by no means intended to provide or constitute professional advice. Reading our blog does not create a Client/CPA relationship between you and us. The blog, including all contents posted by the author(s) as well as comments posted by visitors, should not be used as a substitute for professional advice or as a substitute for communicating with a competent, human professional.

Our blog posts are written using current information and current or proposed rules and regulations. Information becomes old and outdated. Rules and regulations are frequently changed, added, amended, and/or left to expire. This is extremely true with most things tax and to a lesser and slower extent, most things accounting. We usually do not go back and update posted blogs. Always check with your CPA or accountant regarding not only rules and regulations but available options and how it all applies to your fact pattern and you.