HERE’S WHAT’S UP! With middle-class income of $59,200-$107,000, it is going to cost you a whopping $233,610! to raise that kid until the age of 17, says the Department of Agriculture. Families with lower incomes are expected to spend $174,690, while families with higher incomes will likely spend $372,210. This is by definition a long-term investment. After TCJA, the little bundle of joy, doing double duty as a tax deduction still brings government gifts in the form of cash.

‘Of course we love you. You’re our tax deduction…’

REINFORCING THE BASICS.

The kid is no longer counted as an exemption worth a couple of hundred dollars because personal exemptions are long gone. Instead the standard deduction increased to $12,000 for those filing Single and Married Filing Separate; 18,000 for Head of Household; and, $24,000 for Married Filing Jointly and Surviving Spouse. And surviving does not mean you survived another year with him or her! So what tax benefits do you get for the little creatures in the era of TCJA?

FIRST THINGS FIRST.

To be your dependent, a person must be a qualifying child (or qualifying relative). Since we’re talking about the TCJA and Kids, to be a qualifying child, a child MUST:

1. Be your son, daughter, step-child, foster child, brother, sister, half-brother, half-sister, step brother, step sister or a descendant of any of these;

2. Be under age 19 at year-end or under age 24 and a full-time student. These age limits do NOT apply to disabled children;

3. Live with you for more than half the year and must not have provided more than half their own support; and,

4. Not file a joint tax return – unless solely for getting a refund.

WHAT YOU GET.

Child Tax Credit. Now requires the dependent child have a social security number. And it doubles from one thousand to two thousand dollars (through 2025). Twice as much buck for the bang. That’s practically another year of diapers or almost eight pairs of Nike kicks. What if you have a qualifying child (under age 17) but no tax liability or the credit is more than your liability? You can still get free money (refundable credit) and even more of it, $1,400 from $1,000. The phaseout limit more than doubled; it now starts at $200,000 (S) and $400,000 (MFJ). More families with (qualifying) child(ren) will get the Child Tax Credit in 2018 than ever before.

Child & Dependent Care Credit. The TCJA did not change this non-refundable credit. It can reduce your tax bill to zero but you won’t get a refund on anything left over from the credit. If you have some earned income and paid a provider who isn’t you or your spouse, who isn’t a dependent on your return, and who isn’t another of your kids under 18, to take care of child(ren) under age 13, go for it. If you’re married, to get the credit you must file MFJ. $3,000 paid out for one kid, can get anywhere between $600 and $1,050. $6,000 paid out for two or more kids will double those amounts.

Be sure that a provider provides you the all-important Taxpayer Identification Number unless it is a tax-exempt organization for which only name and address need be provided.

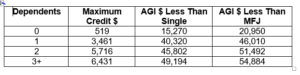

Earned Income Credit. This credit has been helping working people with low to moderate income for 45 years and probably isn’t going anywhere anytime soon.

To see what you could possibly be receiving this year. Calculate My Earned Income Credit

PLANNING TIPS FOR 2019

1. Consider paying a relative to watch your kids. You can get the credit and they get a little cash.

2. If your employer offers a dependent-care assistance program, jump on it. The reimbursement is usually better savings than the credit. And it is exempt from social security. Additionally, up to $5,000 can be excluded from taxable income.

Reach out to McAtee & Associates for answers and guidance all things tax. Carol would enjoy doing some tax planning and advising with you, as well as assisting you with tax preparation and filing.

[email protected] OR 727-327-1999.

Check back here next week where we continue with Part 2 talking about kids and the Kiddie Tax. And be sure to like us on FaceBook and follow us on Twitter; for whatever it is we’ll be posting.

ANY TAX ADVICE IN THIS COMMUNICATION IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY A CLIENT OR ANY OTHER PERSON OR ENTITY FOR THE PURPOSE OF (i) AVOIDING PENALTIES THAT MAY BE IMPOSED ON ANY TAXPAYER OR (ii) PROMOTING, MARKETING OR RECOMMENDING TO ANOTHER PARTY ANY MATTERS ADDRESSED HEREIN.