Last week we broke the news that according to the Department of Agriculture, with middle-class income of $59,200-$107,000, it is going to cost you a whopping $233,610! to raise that kid until the age of 17. Families with lower incomes are expected to spend $174,690, while families with higher incomes will likely spend $372,210. We talked a little about what you get when you have a kid or two or three or four. Specifically, we talked about what makes a dependent, and what the government gives you when you have a kid(s): Child Tax Credit, Child and Dependent Care Credit, and Earned Income Credit. Click here, if you missed it last week.

Get Credit Where Credit’s Due.

AND NOW THERE’S THE KIDDIE TAX

REINFORCING THE BASICS

Kiddie Tax. What is it? The kiddie tax was invented in 1986 to take away advantages to parents shifting unearned/investment income to their children. It was a complicated tax calculation for sure. Up until last year there were two calculations and the second calculation had sub-calculations and bifurcations. (Bifurcating is kind of like sharing your fries.) Then divorce and MFS made it even worse. Basically, Congress’ intent, in the TCJA, was to enable taxpayers to figure out the tax without consideration of the parent’s tax situation.

Net Investment Income Tax (NIIT). What is it? In the case of an estate or trust, the NIIT is 3.8 percent on the lesser of: the undistributed net investment income, OR the excess (if any) of: the adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. (For estates and trusts, the 2018 threshold is $12,500).

Net Investment Income Tax. What isn’t it? It isn’t applied to certain income types that aren’t subject to regular income tax. Some examples are tax-exempt state or municipal bond interest, gain from the sale of a principal residence, and certain VA benefits.

Investment Income. Examples are: interest, dividends, certain annuities, royalties, and some rents (unless derived in a trade or business in which the NIIT doesn’t apply); income derived in a trade or business which is a passive activity or trading in financial instruments or commodities; and, net gains from the disposition of property (to the extent taken into account in computing taxable income), other than property held in a trade or business to which NIIT doesn’t apply.

TCJA AND THE KIDDIE TAX

Let’s look at 2018 to 2025, years in which the TCJA has supposedly simplified the original Kiddie Tax. Most children under 19 and full-time college students under 24 who pay less than half of their own support are subject to this tax on their net unearned income (NUI) as if it was held in a trust. Yes, even though 18 and 24-year-olds are hardly “kiddies” anymore.

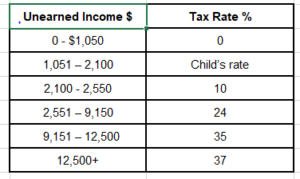

Parent’s tax rates are now irrelevant as the children will be taxed applying trust and estate tax rates to unearned income exceeding $2,100. Although simpler to calculate and providing more privacy for parental tax data, higher taxes may ultimately be paid because trusts have higher tax rates on lower income limits.

Note: The tax rate for MFJ taxpayers in the $600,000 range is 35%, see below the income limit for the 35% trust/estate rate is $12,500. Definitely a huge difference.

Note: The 0% tax rate is attributable to a $1,050 standard deduction.

Kids will be taxed on capital gains and qualified dividend rates are 0% up to $2,600; 20% over $12,700 and 15% for everything in between. Pre-TCJA, the 20% rate didn’t kick in until individual taxable income hit $400,000.

Additionally, kiddie tax keeps company with the net investment income tax (NIIT). This NIIT is an additional 3.8% surtax on AGI exceeding $12,500. That could make the tax nearly 41 cents of every dollar. You may think of this as adding insult to injury.

Despite Congress’s intent to make the kiddie tax easier, the TCJA has actually complicated it even more. The concept of “earned taxable income” (ETI) while relating only to the computation of the kiddie tax, it has the potential to create confusion in at least two ways. First, the term “earned taxable income” is very similar to the term “earned income” but these items are computed in different ways. ETI is taxable income less NUI while earned income is the total of all the child’s compensation received for services provided during the year and taxable distributions to the child from a qualified disability trust. Next, if a child only has unearned income in a given tax year, the child has ETI because ETI = TI – NUI. Shameless Plug. Don’t worry, we totally understand all this new stuff.

KIDDIE TAX PLANNING TIPS FOR 2019

1. Consider transferring income-producing property to your children when they are too old for the kiddie tax but young enough to have a lower tax rate than you.

2. Or consider transferring property that defers income recognition until the child is past the kiddie tax. For example: growth stocks, mutual funds, remainder interests in property/land, tax exempt bonds, closely held stock and market discount obligations.

3. Evaluate including your child’s investment income on your return because more investment interest expense may be deductible and/or your individual tax rate may be lower than the tax rate applied to your dependent child’s unearned income.

WHAT ELSE SHOULD I KNOW?

⇒ Irony. Top-bracket parents and grandparents are probably able to transfer more money to kids before triggering a higher tax than parents and grandparents in the lower-bracket adults. The top tax rate of 37% begins at $600,000 of taxable income (TI) for married taxpayers filing jointly and at $12,500 for trusts. That means a top-bracket family can transfer up to $12,500 of gains or other unearned income to a child or grandchild before the 37% rate is triggered on the child. But an adult in a lower tax bracket has to transfer less than $12,500 before the child begins paying a higher rate than the adult would pay.

⇒ Consider bequeathing kids subject to the Kiddie Tax a ROTH IRA instead of a Traditional IRA.

⇒ Remember investment fees and expenses are no longer tax deductible but investment interest expense may be.

⇒ You can still opt to report your child’s dividends, interest income, and capital gain distributions up to $10,500 on your tax return by filing Form 8814, Parents’ Election to Report Child’s Interest and Dividends.

⇒ Shameless Plug. We like taxes and kids and we sure can help you with the calculating and tax planning for the kiddie tax.

Reach out to McAtee & Associates for answers and guidance all things Kiddie Tax and more. Carol would enjoy doing some tax planning and advising with you and assisting you with tax preparation and filing.

[email protected] OR 727-327-1999.

Check back here next week for a new and entertaining blog. And be sure to like us on Facebook and follow us on Twitter; for whatever it is we’ll be posting.

ANY TAX ADVICE IN THIS COMMUNICATION IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY A CLIENT OR ANY OTHER PERSON OR ENTITY FOR THE PURPOSE OF (i) AVOIDING PENALTIES THAT MAY BE IMPOSED ON ANY TAXPAYER OR (ii) PROMOTING, MARKETING OR RECOMMENDING TO ANOTHER PARTY ANY MATTERS ADDRESSED HEREIN.