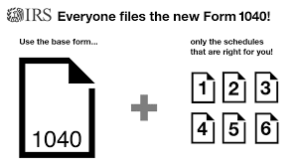

HERE’S WHAT’S UP! The “Post Card 1040” is here! Except it’s not a post card. It is a “building block”. It’s smaller. But not much smaller. Because it’s only on half the page. It’s shorter. But not so much. Because there’s all the old familiar schedules plus half a dozen or so new ones. This is one of those times when a picture is really worth a thousand words. The Building Block 1040. The Building Block 1040.It’s simpler. But not really. This year has 117 pages of instructions; last year there were 107 pages.

It’s smaller. But not much smaller. Because it’s only on half the page. It’s shorter. But not so much. Because there’s all the old familiar schedules plus half a dozen or so new ones. This is one of those times when a picture is really worth a thousand words. The Building Block 1040. The Building Block 1040.It’s simpler. But not really. This year has 117 pages of instructions; last year there were 107 pages.

REINFORCING THE BASICS.

Where to begin? There is no more Form 1040A and no more 1040EZ. We guess that’s good. We never used them anyways. And we’re pretty sure those were the only two forms eliminated. Well, there used to be Form 8917, Tuition and Fees Deduction. No deduction anymore, no form anymore. Basically, a lot of the stuff that was (reported) on the old 1040 will now still be calculated on the same old worksheets and same old schedules but instead be reported on new schedules that supplement the new 1040.

THE 1040.

As you saw, new page 1 is the taxpayer info from the old page 1 and two tiny sections from the old page 2. It is all word information. And the new page 2 sort of lumps some income, some taxes, some credits, the deduction(s), and the refund info all together; all number information. Take comfort in that at least the Refund and Amount You Owe parts are the exact same and the (nondeductible) donation to the “Presidential Election Campaign” is still present begging for money. And the much talked about and yet to be fully figured out “Qualified Business Income Deduction” is on page 2, line 9. Shameless Plug – We must admit we do have it figured out. AGI is no longer line 37. It is now line 7 and begins on page 2. That is good to know because AGI is still a very important number in all those calculations that you don’t see.

AND THE NEW SCHEDULES ARE.

Schedule 1, Additional Income and Adjustments to Income. Additional income is other than wages, interest, dividends, pensions, IRAs, and social security. All income used to be on the old page 1. Use this schedule for capital gains, 1099-Gs from states, Sched C and farming income, rents and royalties, unemployment, and other income. The adjustments are just about the same, with the exceptions of the tuition and fees deduction which no longer exists and the Domestic Production Activities Deduction which appears not to have its own line yet. Take a look.

Schedule 2, Tax. Has two whole things on it: AMT and Excess Advance Premium Tax Credit Repayment, which were both on the old page 2. Take a look.

Schedule 3, Nonrefundable Credits. These half-a-dozen or so items used to be on the old page 2 under Tax and Credits. Nonrefundable credits are the cash government gives you that lowers your tax liability to zero dollars. And that’s it; unlike refundable credits. Take a look.

Schedule 4, Other Taxes. Same exact thing as Other taxes on the old page 2. Except there’s this new and nasty Section 965 transition tax thing. No worries, as long as you are not a U.S. shareholder in a specified foreign corporation. Take a look.

Schedule 5, Other Payments and Refundable Credits. You’re going to remember these from the old page 2, Payments; except for Federal Withholding, Earned Income Credit, Additional Child Tax Credit, and American Opportunity Credit. The latter are all on the new page 2 now. Take a look.

Schedule 6, Foreign Address and Third-Party Designee. Why isn’t this on Form 1040 Page 1? Which is where it used to be. Take a look. Last one !

WHAT ELSE SHOULD I KNOW?

⇒ Last year for both the “Full-year health care coverage or exempt” box (new page 1) and the “Health care: individual responsibility” tax (Schedule 4).

⇒ You didn’t even have to read this if you use over the counter software. Maybe we should have said that in the beginning.

⇒ Nothing, if Carol prepares your tax return.

The tax forms did not get lesser nor easier and neither has the tax preparation and planning. But McAtee & Associates is here for you. Carol would enjoy doing some tax planning and advising with you and assisting you with tax preparation and filing.

[email protected] OR 727-327-1999.

Check back here next week when we tackle another topic. Qualified Business Income Deduction calculations, where bigger is truly better. If there is anything you would like to know more about, leave a comment and we’ll blog it. And be sure to like us on Facebook and follow us on Twitter ; for whatever it is we’ll be posting.

ANY TAX ADVICE IN THIS COMMUNICATION IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY A CLIENT OR ANY OTHER PERSON OR ENTITY FOR THE PURPOSE OF (i) AVOIDING PENALTIES THAT MAY BE IMPOSED ON ANY TAXPAYER OR (ii) PROMOTING, MARKETING OR RECOMMENDING TO ANOTHER PARTY ANY MATTERS ADDRESSED HEREIN.