Pay tuition. Get tax credits. $2,500 here; $2,000 there. Education credits are seemingly straightforward but are they as straightforward as they seem? Not really and not always. Shameless plug. We just make it look straightforward.

REINFORCING THE BASICS.

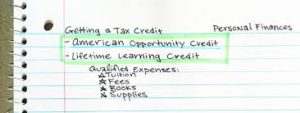

The American Opportunity Tax Credit (AOTC) offers a 100% credit of the first $2,000 in qualified education expenses and an additional 25% on the next $2,000, for a maximum tax credit of $2,500. The available credit is 40% or $1,000 refundable, meaning you might get some cash back after the tax liability is reduced away to $0. This is for 2018 and 2019. The AOTC is limited to a student’s first four years of higher education provided the student is enrolled at least half-time for at least one academic period during the tax year and is learning towards a degree, certificate, or other recognized educational credential. If you haven’t picked a major yet: Bagpiping (Carnegie Mellon), and Citrus (Florida Southern College).

The Lifetime Learning Credit (LLC) offers a credit for 20% of up to $10,000 in qualified education expenses. Thus, a maximum credit of $2,000 is available to qualifying students. This is for 2018 and 2019. The credit is non-refundable, meaning it only reduced tax liability. Eligible students enrolled in courses at an eligible college, university, vocational school, or other postsecondary institution can claim the LLC. There is no limit on the number of years the student can claim the credit and no restrictions on what classes you can take. This is a per-student, per-year credit. How about a course on politicizing Beyoncé or Advanced Producing: Script to Screen taught by Matthew McConaughey? America’s Next Top Professor teaches a course at Stanford about building a personal brand.

WHAT QUALIFIES FOR A CREDIT?

Tuition and qualified related expenses qualify. Tuition and student activity fees are qualified expenses when paid to an eligible educational institution as a condition of enrollment or attendance. But what are qualified related expenses? Books, supplies, computers, software and the like. For AOTC these items can be purchased from the school or elsewhere, like Amazon Prime.  The LLC requires these otherwise qualified expenses be bought from the school.

The LLC requires these otherwise qualified expenses be bought from the school.

What are NOT expenses? Examples of nonqualified expenses include: dorm living; insurance; medical expenses; transportation; personal living or family expenses; education that involves sports, games or hobbies; and, any non-credit course unless it is part of the student’s degree program.

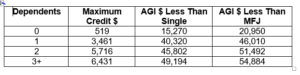

Even after the TCJA, students can claim the credit only if they provide more than half of their own support. And the credit can be claimed by the parent only if the parent claims the student as a dependent (there are no more dependency exemptions).

NOT SO STRAIGHTFORWARD.

Tax-free distributions from a Coverdell ESA or qualified tuition program (Section 529 plan) can be applied to either qualified education expenses or certain other expenses (such as room and board) without creating a tax liability for the student. An education credit can be claimed in the same year the beneficiary takes a tax-free distribution from a Coverdell ESA or qualified tuition program, as long as the same expenses aren’t used for both benefits.

It isn’t as simple as 1 + 1 when scholarships (merit-based) and grants (need-based) come into play. Some can only be used (restricted) for qualifying expenses and others can be used for both (unrestricted) qualified and non-qualified expenses. It is extremely important to know if the scholarship or grant is restricted or unrestricted. For a scholarship (education or athletic) to be completely tax-free, the whole amount of money must be used for qualified expenses. Congress brags that Veterans Benefits and need-based education grants like Pell Grants are tax-free but the same tax laws apply, so that isn’t necessarily always the case.

What usually happens is taxpayers’ look at the 1098-T and subtract the scholarship amount from the tuition paid amount and then claim a credit for remaining tuition on their return. Or the college arbitrarily applies scholarships and grants against tuition and related expenses. So, it appears there is no credit to be had when scholarships and grants received exceed tuition paid. Even worse, that excess is considered income. Schools are not required to issue 1098-Ts when this occurs.

The goal is to maximize the credit by determining the more beneficial credit, AOTC or LLC, and optimizing the scholarship and grant allocation between qualified and nonqualified expenses. Once the credit is maximized, has there been an adverse effect on other credits such as the Earned Income, Other Dependent, or Savers’ Credits? If income is increased does the increased tax credit exceed any increase in federal and state income taxes? To really complicate things, it’s not just a 1040 number’s game. Anytime scholarships and grants are included in income, regardless of whose, future need-based educational assistance could be affected.

WRAPPING IT UP. AOTC is partially refundable and phases out between $80,000/$160,000 and $90,000/$180,000 (Single/MFJ).

LLC is not refundable and phases out between $57,000/$114,000 and $67,000/$134,000 (Single/MFJ).

WHAT ELSE SHOULD I KNOW?

√ The LLC can be used for courses to acquire or improve job skills.

√ Bagpipes aren’t just for funerals and parades. The Chainsmokers.

√ Both credits cannot be taken for the same student.

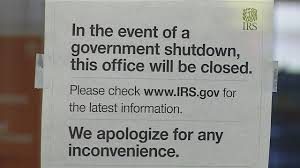

√ If the IRS finds you incorrectly claimed the AOTC, you will have to pay it back with interest. And that’s not all, you could get an accuracy penalty or a fraud penalty. Then they might ban you from claiming it for two to ten years.

√ America’s Next Top Professor is……. Tyra Banks!

Shameless Plug. Straight Forward! McAtee & Associates can optimize a 1098-T (or lack of) into maximum Education Credits. Speaking of maximizing, if you spent some money in 2019 for energy improvements, Getting Paid to Reduce Your Carbon Footprint – Residential Energy Credits, we can optimize that as well.

info@accpas.com OR 727-327-1999.

Be sure to check back here next when we will have blogged about something else. And like us on Facebook and follow us on Twitter; for whatever it is we’ll be posting.

McAtee and Associates’ Disclaimer:

Our blog is intended for educational and awareness purposes. The general information provided about taxes, accounting, and business-related topics is by no means intended to provide or constitute professional advice. Reading our blog does not create a Client/CPA relationship between you and us. The blog, including all contents posted by the author(s) as well as comments posted by visitors, should not be used as a substitute for professional advice or as a substitute for communicating with a competent, human professional.

Our blog posts are written using current information and current or proposed rules and regulations. Information becomes old and outdated. Rules and regulations are frequently changed, added, amended, and/or left to expire. This is extremely true with most things tax and to a lesser and slower extent, most things accounting. We do not go back and update posted blogs. Always check with your CPA or accountant regarding not only rules and regulations but available options and how it all applies to your fact pattern and you.

of land and planes because they don’t fly on wind alone. Oh, and farting cows are really bad for the environment.

of land and planes because they don’t fly on wind alone. Oh, and farting cows are really bad for the environment. Leases and power purchase agreements (PPA) are not eligible for a tax credit. A power purchase agreement is basically paying the solar panel provider a discounted rate for what you use and they sell what you don’t use. Leases and PPAs are typically 20- 25 years in duration.

Leases and power purchase agreements (PPA) are not eligible for a tax credit. A power purchase agreement is basically paying the solar panel provider a discounted rate for what you use and they sell what you don’t use. Leases and PPAs are typically 20- 25 years in duration. Are you below the TI amount, in between TI amounts, or over the TI amount? You could get all, or some, or none of that 20%. Below the TI amount gets you a full 20% deduction. In between and over the amount requires calculating W-2 wages and qualified property.

Are you below the TI amount, in between TI amounts, or over the TI amount? You could get all, or some, or none of that 20%. Below the TI amount gets you a full 20% deduction. In between and over the amount requires calculating W-2 wages and qualified property. subtraction from the tentative QBID. You now have the excess amount.

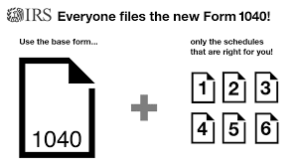

subtraction from the tentative QBID. You now have the excess amount. It’s smaller. But not much smaller. Because it’s only on half the page. It’s shorter. But not so much. Because there’s all the old familiar schedules plus half a dozen or so new ones. This is one of those times when a picture is really worth a thousand words.

It’s smaller. But not much smaller. Because it’s only on half the page. It’s shorter. But not so much. Because there’s all the old familiar schedules plus half a dozen or so new ones. This is one of those times when a picture is really worth a thousand words.

mortgages. Some may have an extra house or two and maybe a 401K and the like. Others may have some medical expenses or college tuition. Update this balance sheet. It’s important to know where you are and where you want to be. Make a plan to reduce debts and increase assets and then achieve The Plan.

mortgages. Some may have an extra house or two and maybe a 401K and the like. Others may have some medical expenses or college tuition. Update this balance sheet. It’s important to know where you are and where you want to be. Make a plan to reduce debts and increase assets and then achieve The Plan. Financial Plan: rebalancing for market volatility and material shifts is fundamental to diversification. Super stereotypical pic, we know.

Financial Plan: rebalancing for market volatility and material shifts is fundamental to diversification. Super stereotypical pic, we know.

REINFORCING THE BASICS.

REINFORCING THE BASICS. upheld Congressional impositions of sa

upheld Congressional impositions of sa and successes, fun and good times that make the Memories of a Lifetime.

and successes, fun and good times that make the Memories of a Lifetime.